us exit tax for dual citizens

Citizenship renunciations with a grand total of 5411 renunciations. US dual citizens who dont live in the US and dont intend to in the future can consider renouncing their US citizenship.

Taxes For Dual Status And Resident Aliens H R Block

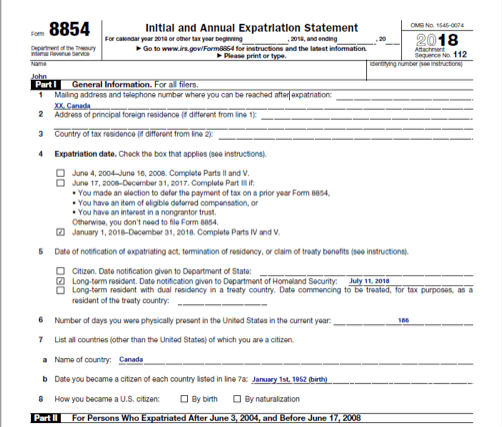

Exit tax is calculated using the form 8854 which is the expatriation statement that is attached on your final dual status return.

. American expats could have a tax relief as a new US bill introduced this month moves towards ending the countrys citizenship-based taxation by only taxing those who live in the US. Citizens who have renounced their citizenship and long-term residents as defined in IRC 877 e who have ended their US. Attach a statement to your return to show the income for the part of the year you are a nonresident.

Eligible deferred compensation items. These simplified single-issue examples are only for clarity. Last year though the IRS quadrupled the citizenship renunciation fee to 2350 nearly 20 times the average of other advanced nations.

This determines the gain on your assets as well as the. Of course you can give up your US citizenship but be aware that this will not have any effect on you US tax liabilities. Dual citizenship also allows citizens to extend citizenship to their children.

This tax is based on the inherent gain in dollar terms on ALL YOUR ASSETS including your home. Relinquishing a Green Card. You also need to have the last five tax years returns filed and all taxes paid to.

But the tax will still be imposed if they have not met the five year tax compliance test. If you have US5 million in gold that you bought at an average price of US1300 per ounce and the price of gold the day you expatriate is US1200 per ounce then you have no unrealized gain and wont owe any Exit Tax. Exit tax is calculated using the form 8854 which is the expatriation statement that is attached on your final dual status return.

Citizen from birth is denied the benefits of the dual citizen exemption to the exit tax which are available to a white dual citizen from birth. However US citizens are automatically liable to expat laws surrounding taxation and as a result are subject to exit tax rules. The 2 million trigger will not apply to certain individuals who are dual citizens at.

Resident on the last day of the tax year. IRC 877 Dual-Citizen Exception Substantial Contacts. When it comes time to expatriate from the United States one of the main concerns for US Citizens and long-term residents is whether or not they will be considered a covered expatriate and subject to IRS rules involving exit taxBeing a covered expatriate means.

I would really like to know if a Canadian born American is subject to the exit tax if they have never lived or worked in the US. Unfortunately it is a misconception that one can do away with ones US nationality without having filed tax returns in the US. I know tax issues need to be handled immediately which is why Im available 247.

Citizens are also US. Phil enjoy your blogs they are very informative and funny at the same time. Its a little different for Green Card Holders if youre considered a long-term resident or Green Card holder for 8 of the past 15 years you could be subject to the exit tax.

Us Exit Tax For Dual Citizens. The legislation has been tabled in the US House of Representatives and would exempt Americans living in countries like Canada. Citizens can choose to give up citizenship or have it taken away from them.

Exit Tax and Expatriation involve certain key issues. You must do something to trigger the application of the exit tax. Section 101 a 22 of the Immigration and Nationality Act INA states that the term national of the United States means A a citizen of the United States or B a person who though not a citizen of the United States owes permanent allegiance to the United States.

I received a question from a reader. Interestingly and regrettably Canadian citizenship laws have been written in ways that could deprive US. 09 January 2019.

Citizenship and to renounce before they become covered expatriates. You will also be taxed on all your deferred compensation. Terminate your citizenship or long-term resident status.

The mark-to-market tax does not apply to the following. To be able to give up US nationality you must have filed 5 years of. The Exit tax occurs from US.

Dual citizens and exit tax September 30 2011 - Phil Hodgen Expatriation. Citizens at birth the benefits of the dual citizenship exemption to the Exit Tax. The Basics of Expatriation Tax Planning.

According to Treasury Department numbers 2016 broke the record for annual US. Tax person may have become a US. Ineligible deferred compensation items.

The became at birth a citizen of the United States and a citizen of another country requirement. Dual citizenship can give people more opportunities to own property since some countries restrict land ownership to citizens. For example you may have inherited a pension from a US citizen have ISAs in the UK have sold or remortgaged a UK property and earn over 107600 in 2020 or 108700 in.

Citizenship if the US. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US. As discussed in this article as a US dual citizen your worldwide income inheritances capital gains investment income savings and more are all subject to US tax rules.

For 2019 the net gain that you otherwise must include in your income is reduced but not below zero by 725000. Tax system a formerly non-US. You must file Form 1040 US.

IRC 877 Dual-Citizen Exception Substantial Contacts. Write Dual-Status Return across the top of the return. Individual Income Tax Return if you are a dual-status taxpayer who becomes a resident during the year and who is a US.

RENOUNCING US CITIZENSHIP AND THE DUAL CITIZEN EXCEPTION TO THE EXIT TAX. How is exit tax calculated. The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria.

Having planned and executed an entry into the US. The exception prevents them from having to catch up with their US taxes before renouncing US citizenship. The exception covers those dual citizens who were born with both US and another nationality that they still have and where they continue to pay taxes and who havent been a US resident for more than 10 out of the last 15 tax years.

IRS tax rules for expatriation from the United States requires a complicated tax analysis to determine if the expatriate must pay US. Generally if you have a net worth in excess of 2 million the exit tax will apply to you. Tax resident or citizen by virtue of having acquired a green card or citizenship see Garcia Tax Planning for High-Net-Worth Individuals Immigrating to the United States The Tax Adviser April 2016 and Garcia and Qian Tax Planning for a.

You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years. Youre going to get taxed by the IRS on that US1 million gain. As weve noted previously possible reasons for the increase in renunciations include the global strengthening and.

This is called citizenship-based taxation If you are a US. Resident status for federal tax purposes. You are not subjected to the exit tax rules simply because you are a citizen or a long-term resident.

But if you are a Green Card holder and have only had it for.

The Complete Guide To Dual Citizenship For American Citizens

The Tax Consequences Of Renouncing Us Citizenship

The Dual Citizen Exception To The Exit Tax Expat Tax Professionals

Taxes For Dual Status And Resident Aliens H R Block

Bookmark Japanese Citizenship Or Dual Nationality Everything You Need To Know Japan Forward

Countries That Allow Dual Citizenship In 2022

Renunciation Of Citizenship Answered Expat Us Tax

Do Dual Citizens Renouncing Us Citizenship Pay Expatriation Tax

How To Expatriate From The United States New 2021

What Dual Citizens Need To Know Before You Renounce Us Citizenship

Form 8854 For American Expats Expat Tax Online

Dual Citizenship Exception To Expatriation Substantial Contacts

Dual Citizens Your Passport Questions Answered

How To Germany Dual Citizenship Germany Usa

Irs Dual Citizenship Taxes A Quick Reference Guide For Expats

Tax Filing For Dual Citizenship Expat Cpa

Irs Exit Tax For U S Citizens Explained Expat Us Tax

The Biggest Cost Of Being A Dual Canada U S Tax Filer Is The Lost Opportunity Available To Pure Canadians U S Citizens And Green Card Holders Residing In Canada And Abroad

What Is Form 8854 The Initial And Annual Expatriation Statement